IPM reaches a key milestone as it announces the signing of definitive agreements for the acquisition of a stake in Dunkerque LNG terminal, expected to be one of the largest European infrastructure finance deals of the year.

PARIS/LONDON/SEOUL (12.7.2018) – IPM Group (comprised of InfraPartners Management LLP and InfraPartners Management Korea Co. Ltd.), the fund management and advisory group based in London, Seoul and Bratislava, has today entered into definitive agreements with the existing owners of Dunkerque LNG terminal to acquire 39.24% of the terminal’s holding company, Dunkerque LNG SAS from EDF and Total, in partnership with Samsung Asset Management Co. Ltd. acting on behalf of a consortium of Korean investors comprised of Samsung Securities Co. Ltd., IBK Securities Co. Ltd., and Hanwha Investment & Securities Co. Ltd.

Pursuant to the agreements, EDF and Total will exit their entire shareholding in the terminal, with the remainder of their shares in Dunkerque LNG SAS being acquired by Fluxys, the existing gas operator of the terminal acting in consortium with AXA Investment Managers and Credit Agricole. The transaction consortiums being led by IPM Group and Fluxys attribute an aggregate enterprise value of EUR2.4bn to Dunkerque LNG SAS.

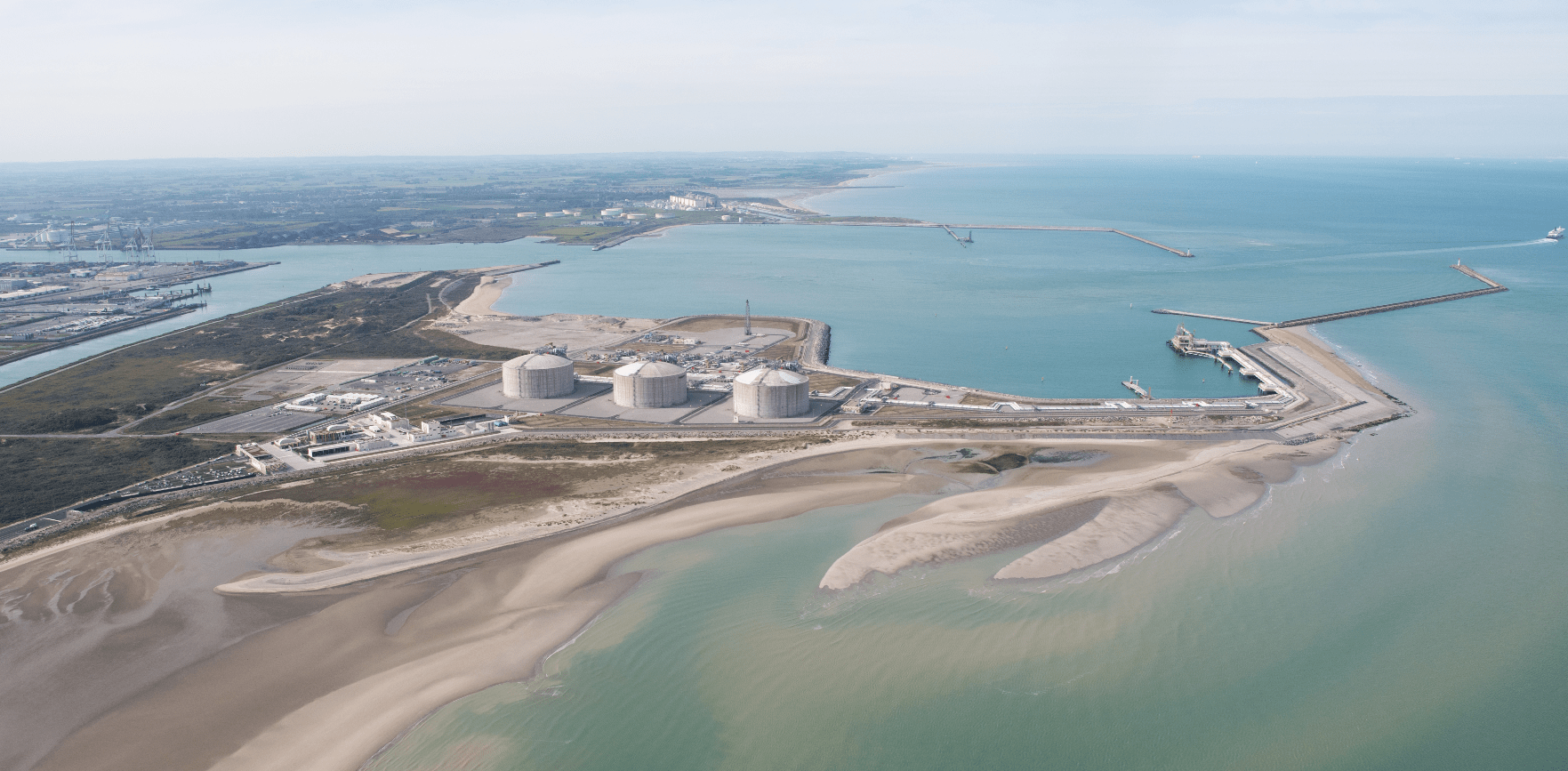

Dunkerque LNG terminal in northern France is among the largest European terminals for the import of liquified natural gas and is connected directly to the gas networks of France and Belgium, capable of satisfying 20% of the total gas demands of those markets. The flexibility of the terminal also enables it to serve the gas markets of the United Kingdom, the Netherlands, Germany and beyond. The quality of the terminal’s design, the strength of the business and the positive prospects for the LNG market in Europe make it a compelling investment case for IPM Group’s investors.

The sale by EDF and Total of their stakes in the terminal attracted some of the most renowned players in the infrastructure finance sector. “We are thrilled that IPM was able to compete with big industry names and secure this asset for the investors,” said Marian Bocek, IPM Managing Partner. “We are very proud of what our London and Seoul investment teams have accomplished so far on the deal, and of the support provided by our Bratislava office on such a high-profile transaction.” added Mr Bocek.

Mr Jurae Kang, CEO of IPM Korea said, “The partnership between our Korean and European teams is proving successful in providing Korean institutional investors with access to quality global infrastructure transactions. We look forward to working with Fluxys to ensure the continuing success of the terminal.”

The acquisition completion is expected in the second half of 2018.